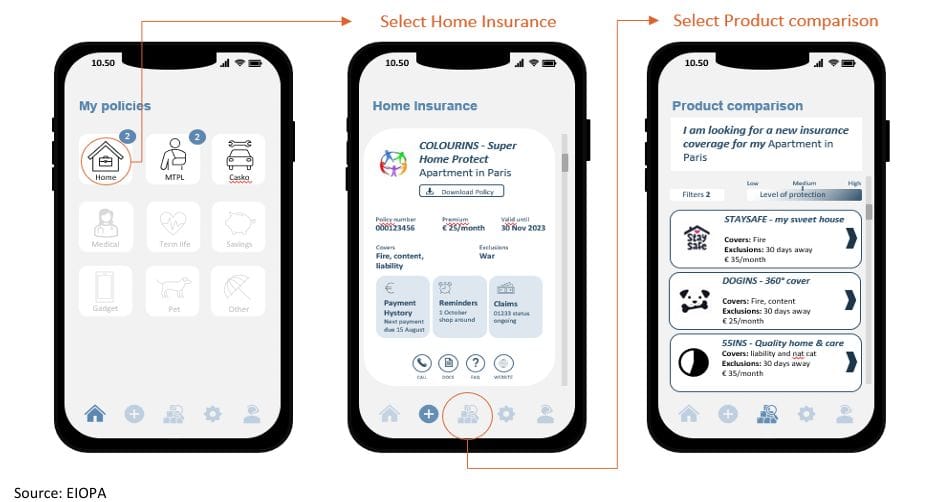

Open Insurance Use Case: Insurance Dashboard

Currently, consumers are unable to access a single, user-friendly overview of their existing insurance policies—but open insurance can change that.

It is also difficult for consumers to compare their current policies with new offers during the purchasing process, making it harder to make informed decisions about switching or supplementing coverage.

Open insurance can address that challenge as well.

An insurance dashboard, built on open insurance or a broader open finance framework, could help resolve these issues by collecting and displaying a consumer's existing insurance policies—including embedded coverage—and related information in one place.

It would function as a central point of access, aggregating data from all insurers and intermediaries with which the consumer has a relationship.

Moreover, the dashboard could enable other insurance providers to present their offerings, allowing consumers to compare coverage options and prices across the market.

This would provide a comprehensive view of an individual's insurance position and empower them to evaluate alternative products, ultimately supporting more informed decisions.

It would be a valuable digital tool for accessing and understanding insurance coverage in a meaningful, user-centric way.

Enhanced trust. More choice. Better, more informed decisions. Stronger financial resilience. These are exactly the kinds of outcomes we aim to achieve through the Savings and Investments Union (SIU).

I suggest to keep that in mind as we continue the discussion on the Financial Data Access Regulation (FiDA) here in Europe.

Member discussion